Google the octopus: With Google Compare conquering the world of insurance

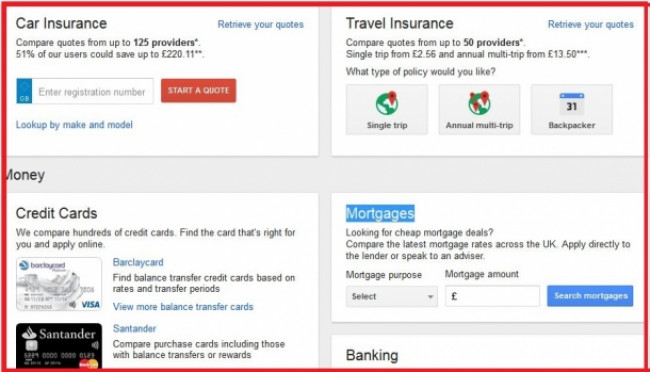

In the pilot project Google Compare in Great Britain, Google collaborates with the following insurance companies and financial service providers amongst others: Insure for All, Bath Building Society, dialdirect, Axa, flied, Quote a Car, Admiral, paragon mortgages, kensington, State Bank of India. Google Compare UK is currently active in the business sections Car Insurance (125 providers), Travel Insurance (50 providers), Credit Cards (hundreds of different credit card providers), Mortgages and Banking. Google Compare UK seems to be successful enough to justify a worldwide rollout. Banks and insurance companies are in for a rough ride.

Google is becoming more and more of an octopus. Several sources report that US market-listed Google Inc. has increased its efforts to enter the international billion Dollar market of insurance brokerage. Google has named its new project Google Compare which has been running as a pilot project in Great Britain since 2012. The corporation is now preparing to roll out Google Compare on the world stage.

For years, Google could use their customer's AdWords accounts to figure out which keywords booked for Google's online advertisements led to customers clicking links, therefore creating revenue, and which ones did not. So we are talking about the cradle of the e-commerce economy, the cradle of the e-commerce society - and it all pivots around Google, everywhere in the world.

Simple numbers show just how reliant the German economy is on the American business tycoon Google: some German Google customers already pay more than 100 million Euros every year for online advertisement which is shown to customers in their Google search results after a completed search query.

Adding these up, you quickly realise: There are German companies which have given more than 1 billion Euros to Google Inc. in the part ten years.

German companies already paid more than 1 billion Euros to Google Inc.

Hundreds of thousands of advertisers in the service sector have paid a lot of money to Google Inc. for having their company advertisement placed above, under or to the right of the search results after a customer ran a specific search via Google. These advertisements are efficient to the point that there are companies, even German ones, turning over way more than one billion Euros every year which would not exist without these advertisements.

This makes it clear that Google is a decisive factor in company success and gains more and more levering power every year regarding the market impact of continuously growing parts of economy - German economy included.

It all adds up to a lot of money and a lot of knowledge that Google has now started to invest - into the development of Google business sections which are generally in direct competition to Google's own customers. Their newest project gaining momentum is Google Compare.

A number of US blogs, referring to an analyst, claim that Google Compare, Google's own price comparison service, is said to launch in several states in the US in the first quarter of 2015.

Google Compare earns money by having companies pay for successfully brokered products and services. To start things off, Google Compare's first project in the USA is to build up the biggest financial service providers for car insurances.

Financial services are an international market worth trillions of Euros

It's obvious that the US company Google won't be content doing small business but instead looks at a billion Euro market. As an example, the German financial service provider MLP AG (former Marschollek, Lautenschläger und Partner AG) manages financial assets comprising insurance policies and other financial products worth more than 20 billion Euros. And MLP is only one of hundreds of financial service providers operating internationally. This is the type of mega-business that Google Inc. wants to access with Google Compare: a trillion Euros market.

Google's approach is based on long-term thinking and doesn't stop at competition distorting measures. This becomes obvious when looking at the following fact: almost all major German price comparison websites have become less visible in Google's search results after a customer's search query (some have dropped by as much as 80%!), comparing the last seven months starting April 2014. This is shown very clearly by independent analysis services such as SISTRIX.

Political figures are alarmed, for example in Germany. It has started to dawn on them: Google's power is a power that shapes Germany's economy.

Netz-trends.de knows: charts of the noticeable and severe losses in visibility of German price comparison websites directly competing with Google are passed around on the highest political level - amongst others in the German Federal Ministry of Economy. These charts raise the red flag with the German Federal Minister of Economy Sigmund Gabriel (SPD) who has previously strongly criticised Google and even indirectly threatened the company with antitrust measures.

Google took precautionary measures and devalued Google Compare's competitors

Whether it is idealo.de, billiger.de, guenstiger.de oder preisvergleich.de: Google Inc. reduced the visibility ranking of many of these websites, almost always by 80%, and gave shady explanations - they were purportedly trying to raise the websites' quality. Even though the situation is currently improving, the powerful symbol of Google's might remains.

This is fact: A loss of 80% in Google search result visibility shown after the customer has completed a search query - which is what many major German price comparison websites had to deal with in the latter half of 2014 - means an almost equal amount of loss in revenue. So an 80% loss in Google visibility means 80% loss in revenue, loss in profit and is ultimately a serious threat to jobs.

Google Compare - Google's competing product to online price comparison websites - will massively pressurise German insurance companies such as Allianz, HUK-Coburg, Ergo Insurance Group or the Swiss company Zurich Versicherung in the medium and in the long term.

As Google's power is increasing, these insurance giants loose power and influence to Google and its nice headquarters in Mountain View, California - like puppets on a string to their puppet master.

Google, one of the top 20 companies worldwide with an unbelievably high annual profit, has long stopped being content with the search engine market. The margin of currently around 70 billion US Dollars revenue and more than 14 billion Dollars profit that they aimed for over the last 15 years has become nothing but an intermediate process stage. There are, for example, Google in-house experimental games that aim at doubling these numbers within the next five to ten years.

Google is mightier than the DAX company Siemens

Google's revenue at least has already reached the same level as Siemens'. With one major difference. The German DAX company Siemens employs more than 300,000 people. Google Inc., however, only employs 52,000 people.

Google's annual profit is also several times higher than Siemens' profit. This is an economic force which the United States massively benefit from. In Germany alone, Google Inc. (including the German revenue of its subsidiary YouTube) makes more than 3 billion Euros annual profit, according to estimates. However, the corporation doesn't pay taxes in Germany as Google has escaped to the tax haven Ireland and purportedly operates a complex network of letterbox companies in Luxembourg, too.

From Google's point of view, it makes a lot of sense to exhaust their monopoly on the search engine market (90% market share in Germany alone) - following the example of the former American oil monopolist Rockefeller.

The genius American entrepreneur John D. Rockefeller completely turned around the US oil market in 50 years between 1860 and approx. 1910 and built up an unprecedented economic monopoly with his Standard Oil Company.

It was not until 1911 that Standard Oil was ruled to be dissolved into more than 30 companies by the Supreme Court - after years of litigation. The Sherman Antitrust Act established in 1890 (so 30 years prior) was aimed at stopping Standard Oil devouring rival companies but proved to be ineffective.

Google is heading in the same direction as Rockefeller's Standard Oil

In Google's case, one thing is becoming increasingly clear: the situation is heading towards a similarly mighty monopoly with political and legislative challenges which could possibly be similarly complex as the ones faced in the case of Rockefeller and his company Standard Oil. Rockefeller's power can still be admired today: it has been symbolically cemented into the skyline of New York City with the world-famous Rockefeller Center.

The term Google Compare is ultimately misleading. Google Compare does indeed show price comparisons, however, as almost any price comparison website, lives off the commission that the advertised companies pay for brokered products and services - to Google Inc.

The same is already true for any other Google "price comparison website," for example Google Products, Google Flights or Google Hotelfinder. Google aims at being the most powerful company worldwide within all these business sections and is willing to compete with their own customers - ultimately through unfair and rarely regulated competition.

In any case, Forrester analyst Ellen Carney now expects Google to drive its mega-mighty project Google Compare to launch in Illinois, USA, and three other US states (for a start!) in the first quarter of 2015 - their project to become the world's biggest financial service provider. Google is becoming an insurance company, Google is becoming a bank.

Forrester: "Google Compare is going to have big implications for US insurers"

Therefore it is safe to assume: Google's plan to enter the insurance market should, in the medium term and the coming years, lead to tectonic plate movements in the entirety of the worldwide financial market, not excluding the European Union (EU). Forrester Analyst Ellen Carney still limits her views to the US market by saying that she assumes that "Google Compare is going to have big implications for US insurers." However, the EU is likely to be Google's next target, especially the financially strong German market.

It's a known fact that Google Inc. has obtained a broker license for the US market which means that they are allowed to broker insurances. This entitles Google to sell insurance policies for the US insurance companies Maryland, MetLife, Mercury, Permanent General Assurance, Viking Insurance of Wisconsin and Worksmen's. Google will get commissions on policies it sells.

Google's massive competitive advantage: Big Data

The blog also mentions that Google collected data from hundreds of millions of people who used Google as their search engine, albeit in a controversial manner. The corporation now still has big data that nobody else has. Google might now use this data to become a major player in the billion Dollar market that is insurance.

Google only says that Google Compare offers an added value for its users since nobody knows as well as Google what customers want.

Providers of price comparison websites, German ones included, counter that price comparison websites are already very efficient at comparing insurance prices for consumers and that they already make it possible to buy insurance policies online.

Therefore Google Compare does not offer increased user friendliness, instead Google misuses the power it has over the market by driving forward an already existing distortion of competition, explains the manager of a price comparison search engine based in Southern Germany to Netz-Trends.de:

Worried about Montezuma's revenge (say: Google's revenge) he would rather not have his name printed. He prefers to duck away from the US corporation Google that ultimately made his price comparison website what it is and could potentially be badly damaged by Google Compare. On a side note:

according to an analysis by the US financial service Bloomberg, Google's stock exchange value is currently higher than the value of all market-listed companies in Russia combined. Website Google Compare https://www.google.co.uk/compare/