Google flattens German price comparison portals like Billiger.de or Idealo to strengthen itself

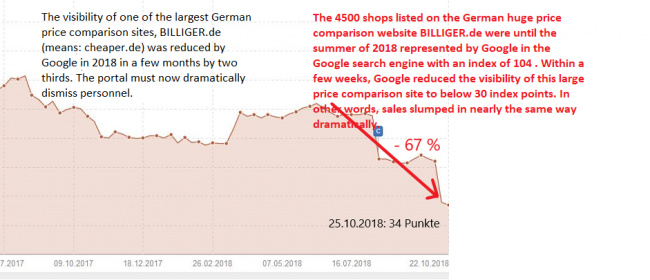

From kk / mp - Within just five months, the German price comparison portal billiger.de lost more than two thirds of its visibility on the Internet search engine Google in 2018 alone.

But without visibility there is no turnover, there is no profit. The result: employees have to be laid off, Germany as an Internet location is weakened further. A trend that has persisted for years. The winners are the major digital corporations in the USA, where more and more profits and sales are being shifted - sometimes also by tax tricks.

The example of the once leading German price comparison portal billiger.de, a legend in the German Internet scene, once again shows how dependent the global e-commerce trade is on Google. On billiger.de alone, over 5000 predominantly German online shops are contractually listed. If you consider the shop-in-shop solutions, there are even more than 50,000. From Otto to Amazon, from Reuter to Media Markt, everything is there.

The decline of price comparison portals such as billiger.de brought about by Google also shows how audaciously Google is destroying competitors: despite an EU requirement not to hinder free competition for independent price comparison portals, let alone destroy it. In his wedding billiger.de had about 230 employees, now it is under 200.

For connoisseurs of the scene, it is clear that the search engine operator Google, a subsidiary of Alphabet Inc., wants to push its own services even more aggressively than before so that national subsidiaries like "Google Germany" can deliver even more profits to the headquarters in Mountain View. After all, Germany is considered the second most important Internet market for Google directly after the USA.

Market experts estimate that Google in Germany alone could generate annual profits of over 3 to 5 billion euros without having to pay large taxes. There are no official numbers on this. Google is also a master at concealing profits and making them smaller than they are by investing heavily in other business areas.

Many e-commerce companies depend heavily on the welfare of the Internet giant Google. After all, the following principle applies in the World Wide Web: Whoever is not found via the search engine is virtually unknown on the Net and cannot do business either. In fact, it does not exist, since around 98% of all search queries on the Internet in Germany are made via Google. A monopoly, then.

This makes it all the more dramatic for companies or other websites if they rank much worse in the search engine after a Google update. Just like it happened to the portal billiger.de again. From June to October 2018 alone, the price comparison lost more than two thirds of its visibility in Google.

To Shopping and search terms such as washing machine one finds billiger.de on the first ten Google sides now no more at all. For the portal a catastrophe that is certainly not only owed to Google's own SEO, as it likes to claim after updates.

No: Behind such a massive displacement of portals is a cool calculation strategy by Google, which reads: What portals like billiger.de lose, providers like Google win themselves.

Google punishes price comparisons and strengthens its own services

The price comparison site billiger.de belongs with the provider idealo.de (portal of Axel Springer) to Germany's last two leading relevant independent price comparison portals. Among others, Müller Medien from Nuremberg (operates Yellow Pages as well as numerous local radio stations), Deutsche Telekom and Heise are involved in billiger.de.

The business principle of price and product comparison sites is based on creating price and product quality transparency among millions of products sold on the Internet from all possible categories. This is how the user should get an online shopping compass.

By clicking on one of the thousands of listed shops, a price comparison portal either receives a small amount - for example 20 cents (pay per click principle) - or it is paid with a small cent brokerage commission.

Every month, 1.79 million people use billiger.de (unique users according to AGOF June 2018). On the portal, consumers can compare around 1 million products and more than 50 million prices. In addition, billiger.de provides the user with numerous additional information. These include, for example, clickable quality features per product, advice texts, test reports and product evaluations. [1], [2]

The extensive offer of billiger.de and similar portals is Google a thorn in the side. Finally the search machine operator would like to advance its own price comparison service Google Shopping. Users who regularly search via Google will inevitably come into contact with the service. The search engine automatically displays product ads matching the search term entered. Each click on a Google Shopping ad earns the search engine operator money.

Google Shopping digs competition out of the water

The "Google Shopping" products are usually displayed very prominently to the right of or above the search results. In contrast to AdWords ads, Google takes it upon itself here exclusively to publish product photos prominently. Due to the optical highlighting, they are very well perceived by the customer. This gives the search engine giant an enormous competitive advantage over its competitors. Most of the ads are placed by Google itself. This double strategy is used to specifically checkmate other shops.

What is of course advantageous for Google, has a negative effect on price search engines such as billiger.de or idealo.de. After all, the group is digging away the traffic from the well-known competitor portals in Mountain View.

This is also reflected in the following figures: Just five to ten years ago, there were 50 independent price comparison portals in Germany that could carry themselves independently. This figure has shrunk considerably in recent years. Meanwhile one can speak only of two significant portals - just idealo.de and billiger.de. All other price comparisons have disappeared from the market or play only a minor role.

At the same time, Google has recorded record sales in recent years. From 2013 to 2017, the IT group almost doubled its revenue - from USD 55.51 billion to USD 109.65 billion. [3]

This massive increase in sales is partly due to Google's aggressive strategy of crowding out the market. The Internet group does not shy away from unfair competition practices.

Only in the summer of 2017 did the EU Commission impose a record fine of 2.42 billion euros on the search engine operator. The allegation is that Google 'systematically placed its own price comparison service at the best position' and also 'discriminated against competing services in its search results'. [4]

Low visibility is coffin nail for price comparison portals

After the billion-euro antitrust dispute, Google promised to outsource the product ad business to an independent unit, which would then compete with other shopping portals for advertising space in a "fair competition". But even after the new model, the rivals saw themselves at a disadvantage, as they would have to bid directly against Google instead of receiving free advertising space. [5]

Google obviously does not itch the punishment. Instead, the Internet group is trying to further weaken competitor services. The falling visibility values of competitors are a good indicator for this. For some e-commerce companies, these are now in an existentially threatening area. [6]

Germany's billiger.de, for example, has lost more than two thirds of its visibility in just a few months. While the visibility index still stood at 104 points in June 2018, the figure at the end of October 2018 was just around 33 points. A decline of 68 percent (source: Sistrix).

In mid-November 2012, the visibility index of billiger.de stood at around 208 points, and in mid-2016 at around 170 index points. Starting from its peak, the price comparison portal lost more than 84 percent of its visibility during the years in which Google pushed its "Google Shopping" into the ring and since then has puffed it up.

However, other product and price comparison sites also suffered visibility losses in the Google index. Thus, preisvergleich.de (formerly Unister Holding, Leipzig) had to accept a decline of about 22 percent from June to October 2018 (from about 36 points on June 25, 2018 to 28 points on October 25, 2018).

geizhals.at / geizhals.de (bought by Heise some time ago for around 40 million euros according to market rumours) is also going downhill. In the same period, this price and product comparison lost 19 percent of its visibility in the Google search engine index. According to Sistrix, instead of once 26 index points, Google now only grants this portal a visibility of 21 points. This presentation is based on the comparative period 24 June 2018 to 25 October 2018.

Less visibility means less revenue

Even large portals such as idealo.de were increasingly ousted from the Google index. While the price comparison service from Axel Springer still had a visibility of around 824 points on July 30, 2012, it was just 326 points on October 22, 2018 - a decrease of around 60 percent. For comparison:

According to calculations by European price comparison portals, "Google Shopping" alone now has a visibility index of over 20,000 points in Google.

The fact that the business with price comparison portals is not peanuts is shown by the sales: billiger.de had a peak of more than 30 million Euro sales and 3 million Euro profit per year. According to a market expert, Idealo is said to have delivered profits of 35 to 40 million euros per year to Axel Springer. [7]

The problem for billiger.de, idealo, geizhals.de and Co.: A lower visibility means at the same time a lower turnover, because Google plays out fewer hits of the portals in the search results. An e-commerce expert explains to netz-trends.de: "The loss of visibility is often reflected one-to-one in sales. So halving visibility also halves the revenue generated by Google searches."

Using white label solutions, partnership models and apps, many e-commerce portals tried to become more independent of Google, the expert continued. "Nevertheless, the companies and platforms affected by visibility reductions suffer enormous revenue losses, which would have to be compensated in other ways, but often simply cannot be compensated, because the goodwill of Google is at the centre of most Internet portals.

In addition, leading German price comparison portals have founded a working group in cooperation with the Federal Ministry of Economics to promote solutions for the Google problem. There is agreement that this solution can only lie in strict EU laws and regulations for monopolists such as Google, Facebook or Amazon.

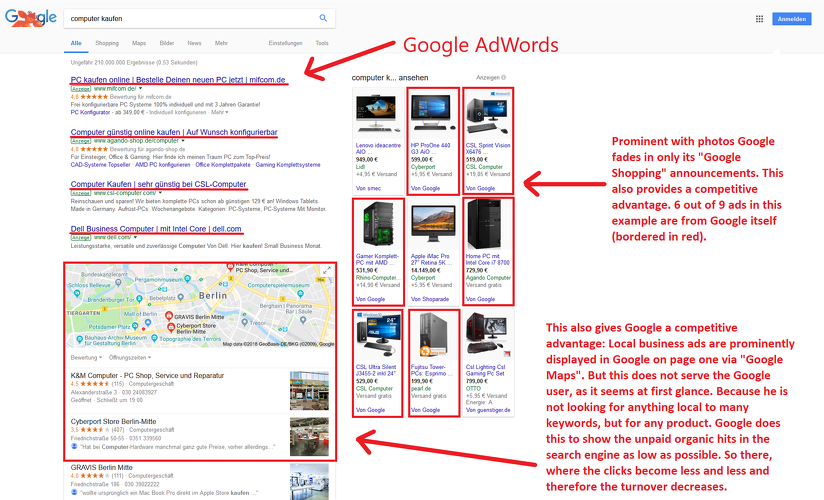

Google commercializes top search results with its own services

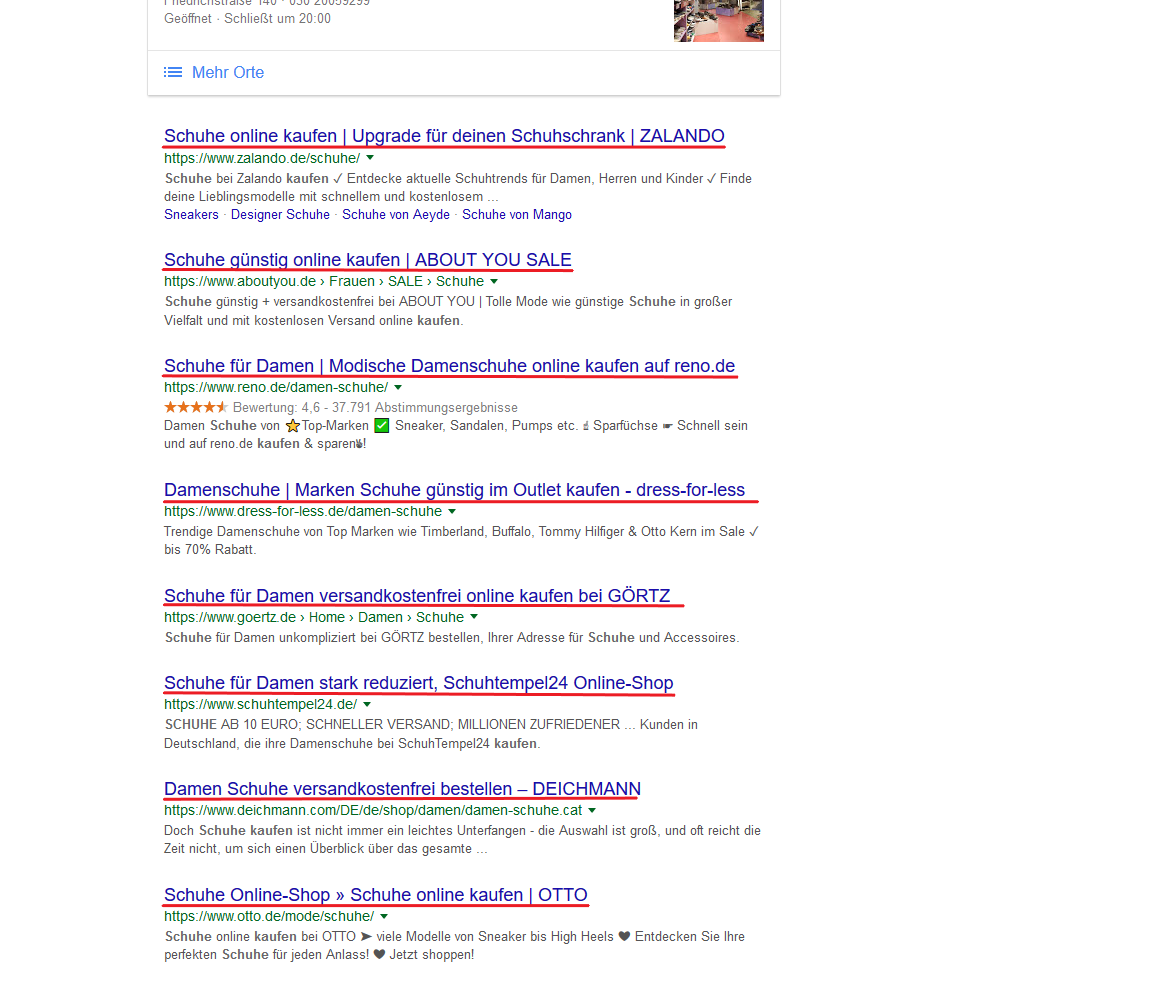

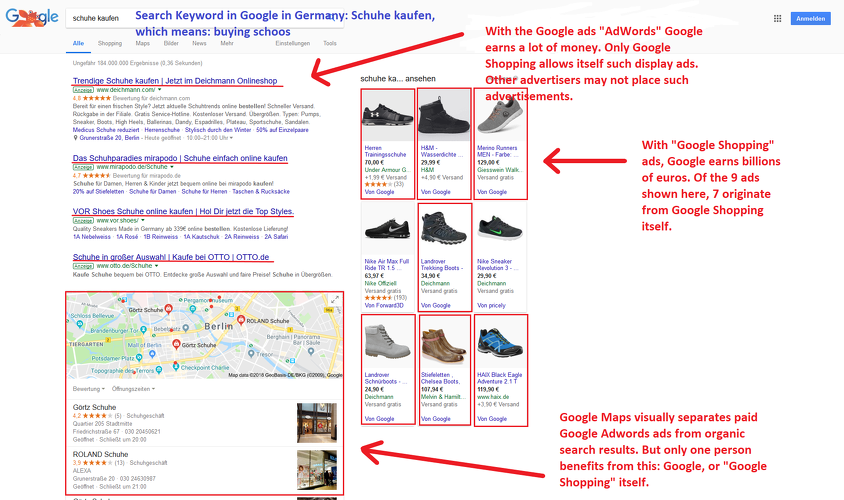

A test of the netz-trends.de editorship shows besides: Google commercializes the Top search results particularly with its own services such as Google Shopping, Google AdWords and Google Maps. For this we first acted in Google as if we wanted to buy shoes and entered the search term "buy shoes" in Google. We then analyzed the contents of the first page. The sample was taken on 25 October 2018 at 14:32.

The result shows how audaciously Google interprets the search results in its favour. In the visible area of the desktop page, the user initially only finds sponsored links to deichmann.com, mirapodo.de, vor.shoes or otto.de purchased through AdWords. To the right of the search results, the Google Shopping ads will be displayed once again. Of the total of nine advertising fields, Google Shopping again occupies around 80 percent. Only two ads are from other providers.

Organic search: brand names more important than consumer benefits

Not to be overlooked is also the prominent placement of Google Maps below the first four sponsored links. The search provider displays various shoe shops nearby on a map. Google seems to initially want to enrich its offer editorially and promote local dealers. But for connoisseurs one thing is clear: in a global mass market like the Internet, this is just eyewash.

In reality, the paid ads that Google earns from are separated from the organic search by the map display. The user's attention is thus drawn massively to Google AdWords and Google Shopping. In addition, the search engine pushes the organic search results further down, and thus also various competitor portals.

But even a glance at the organically generated search results makes one doubt the user orientation so highly praised by Google. Instead of names of different price comparison portals, which actually offer added value by comparing the prices of a product on thousands of available shops, the search engine operator only lists known individual shops such as zalando.de, aboutyou.de or reno.de.

Thus, the most relevant hits are not played out in the consumer's interest, since the individual shops do not offer an independent price comparison, as do, for example, billiger.de, idealo.de and the like.

A similar picture emerged in a second sample on 25 October 2018 at 14:34 with the search term "buy computer". Here, too, the user is confronted above all with Google's services, which primarily earn Google money. Here too, Google cleverly separates the maximum profitable area commercialized in the Google sense from the organic search with its "Google Maps" map service shown in bold on Google's homepage. In our example, six out of nine Google Adwords ads displayed by Google come from "Google Shopping".

Google seizes more and more business areas

In addition to Google Shopping, Google Maps and Google AdWords, the group is gradually trying to conquer other business areas that have previously been opened up by other portals. For example, if the user enters the search term "Flight Zurich" in the Google search engine, Google's own travel offer "Google Flights" appears immediately.

The search term "Hotel Köln" in the top results shows Google's top hotel ads, i.e. the business unit "Google Hotels". Google also wants to grow with this business area, which has been successively pushed by Google for years, because Google wants to have a commission for each hotel room it procures. The same applies to flight ticket brokerage. From Google's point of view, the travel market is also a lucrative billion euro market.

The strategy is clear: Google is now also competing strongly with portals such as booking.com, fluege.de (also formerly Unister Holding) and hrs.com - its own advertising customers. Unister Holding alone is said to have transferred up to 150 million euros annually to Google for Google AdWords travel ads to Google before the death of founder Thomas Wagner (38) in July 2016. Since the founding of Unister in 2002, a good one billion euros of Unister advertising funds have allegedly flowed into Google accounts, netz-trends.de knows from a very well-informed source.

"For a good eight to ten years now, Google has been pursuing a strategy of gradually taking over the business models of other portals," says the e-commerce expert about the search engine giant's approach. "The Group always takes two steps forward and one step back as soon as there is a headwind from politics".

In doing so, Google relies above all on the time factor until a reality is created that is tired of competitors and politicians, of the struggle, finally annoyed and grudgingly accepted, the expert continued. A salami tactic that is supposed to wear down critics.

In addition, the media are also partly to blame for the superiority of the search engine operator: "For years our US-auditing media have been pushing Google, while German companies are partly written in the ground.

Google and Facebook form advertising duopoly on the Internet

But the online business in the EU and in Germany is already firmly in the hands of the USA. According to the US market researcher eMarketer, Google's share of global digital advertising revenues in 2018 is 31.3 percent. The Google subsidiary YouTube still manages to generate 3.4 percent of global online advertising revenues - with an equally strong upward trend.

In second place among Internet advertising monopolists is the social platform Facebook with a share of 18.4 percent. Together with the Facebook subsidiary Instagram, the company founded by Mark Zuckerberg accounts for a full 21.4 percent of global Internet advertising revenues in 2018.

Even today, Facebook, with a turnover of almost 30 billion US dollars, is soon twice the size of Germany's largest media group Bertelsmann from Gütersloh, which includes such well-known brands as RTL Group, Random House and Gruner + Jahr (STERN, SPIEGEL, GEO, Brigitte etc.).

This means that out of every US dollar invested in online advertising worldwide, around 56 US cents go to the advertising duopoly Google and Facebook alone. The other places are occupied by China's online department store Alibaba (9.8 percent), China's leading Internet search engine Baidu (4.3 percent) and the US software group Microsoft (3.1 percent). [8]

Price comparison pages are ground between Google services

Conclusion: Google earns more and more money with every search query thanks to the ever faster suppression of competitors in e-commerce. Already today, about two thirds of Google's home page are commercialized hits in favor of Google for certain Internet search queries by consumers.

Independent price comparison portals such as billiger.de, idealo.de or preisvergleich.de are literally ground down between Google Maps, Google Shopping and Google AdWords ads.

By pushing down unwelcome rivals in the search, Google strengthens its own position.

However, small and medium-sized e-commerce companies are slowly bleeding out and have little chance of taking action against the monopolist. It is therefore all the more important that large EU institutions keep an eye on the business conduct of the US giant and vigorously ensure fair competition on the Internet as well. This, too, is certain, but has still not been done enough so far.

Individual statements:

1] billiger.de - Your price comparison, in: billiger.de, retrieval on October 25, 2018.

2] Daily Digital Facts - June 2018 by Agof Onlineforschung, in: agof.de from July 3, 2018, retrieval October 25, 2018.

3] EU Commission imposes fine of 2.42 billion euros on Google by European Commission - Representation in Germany, in: ec.europa.eu of 27 June 2017, retrieval on 25 October 2018.

4] Google sales worldwide in the years 2013 to 2017 (in billions of US dollars) by Statista, in: Statista.com, retrieval on 30 October 2018.

5] Google Core Update: Health pages and e-commerce portals crash from mp, in: netz-trends.de from September 10, 2018, retrieval on October 25, 2018.

6] Media: Google offers compromise in shopping search by Torsten Kleinz, in: heise.de from 19.09.2017, retrieval on 25 October 2018.

7] Exclusive: Axel Springer intends to sell its shares in Idealo and Ladenzeile. Price could be between 300 and 500 million euros, from : Roland Eisenbrand, in: orm.com from 14 March 2017.

8] eMarketer Chart - Net Digital Ad Revenue Share Worldwide by Company, 2016 - 2019 by eMarketer, in: emarketer.com from March 14, 2017, download on October 30, 2018.